Uber is an American multinational technology company that provides ride-hailing services, courier services, food delivery, and freight transport. It is headquartered in San Francisco, California, and operates in approximately 70 countries principally in the United States and Canada, Latin America, Europe (excluding Russia), the Middle East, Africa, and Asia (excluding China and Southeast Asia), and 10,500 cities worldwide.

As of December 31, 2024, Uber had three operating and reportable segments: Mobility, Delivery and Freight. Mobility, Delivery and Freight platform offerings each address large, fragmented markets.

Uber's mobility offering connects consumers with a wide range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and more—helping customers go almost anywhere they need. Uber’s delivery offering allows consumers to search for and discover the best of local commerce—from restaurants to grocery, alcohol, convenience and other retailers—order a meal or other items, and either pick-up at the restaurant or have it delivered. Uber believes that Freight is revolutionizing the logistics industry. Freight powers a managed transportation and logistics network and connects Shippers and Carriers in a digital marketplace to move shipments while leveraging our proprietary technology, brand awareness, and experience revolutionizing industries. Freight provides an on-demand platform to automate and accelerate logistics transactions end-to-end while providing visibility and control of logistics networks.

To make all their segments working seamlessly, Uber leverages its technology platform which uses a massive network, leading technology, operational excellence and product expertise to power movement from point A to point B. Uber develops and operates proprietary technology applications supporting a variety of offerings on our platform. We connect consumers with independent providers of ride services for ridesharing services, and connect Riders and other consumers with restaurants, grocers and other stores (collectively, “Merchants”)with delivery service providers for meal preparation, grocery and other delivery services. We also connect consumers with public transportation networks. We use this same network, technology, operational excellence and product expertise to connect shippers (“Shipper(s)”) with carriers (“Carrier(s)”) in the freight industry by providing carriers with the ability to book a shipment, transportation management and other logistics services. Uber is also developing technologies designed to provide new solutions to solve everyday problems.

Massive Network Our massive, efficient, and intelligent network consists of tens of millions of Drivers, consumers, Merchants, Shippers and Carriers, as well as underlying data, technology, and shared infrastructure. Our network becomes smarter with every trip. In more than 10,000 cities around the world (as of December 31, 2023), our network powers movement at the touch of a button for millions, and we hope eventually billions, of people.

Leading Technology We have built proprietary marketplace, routing, and payments technologies. Marketplace technologies are the core of our deep technology advantage and include demand prediction, matching and dispatching, and pricing technologies. Our technologies make it extremely efficient to launch new businesses and operationalize existing ones.

Operational Excellence Our regional on-the-ground operations teams use their extensive market-specific knowledge to rapidly launch and scale products in cities, support Drivers, consumers, Merchants, Shippers, and Carriers, and build and enhance relationships with cities and regulators. Product Expertise Our products are built with the expertise that allows us to set the standard for powering movement on-demand, provide platform users with a contextual, intuitive interface, continually evolve features and functionality, and deliver safety and trust

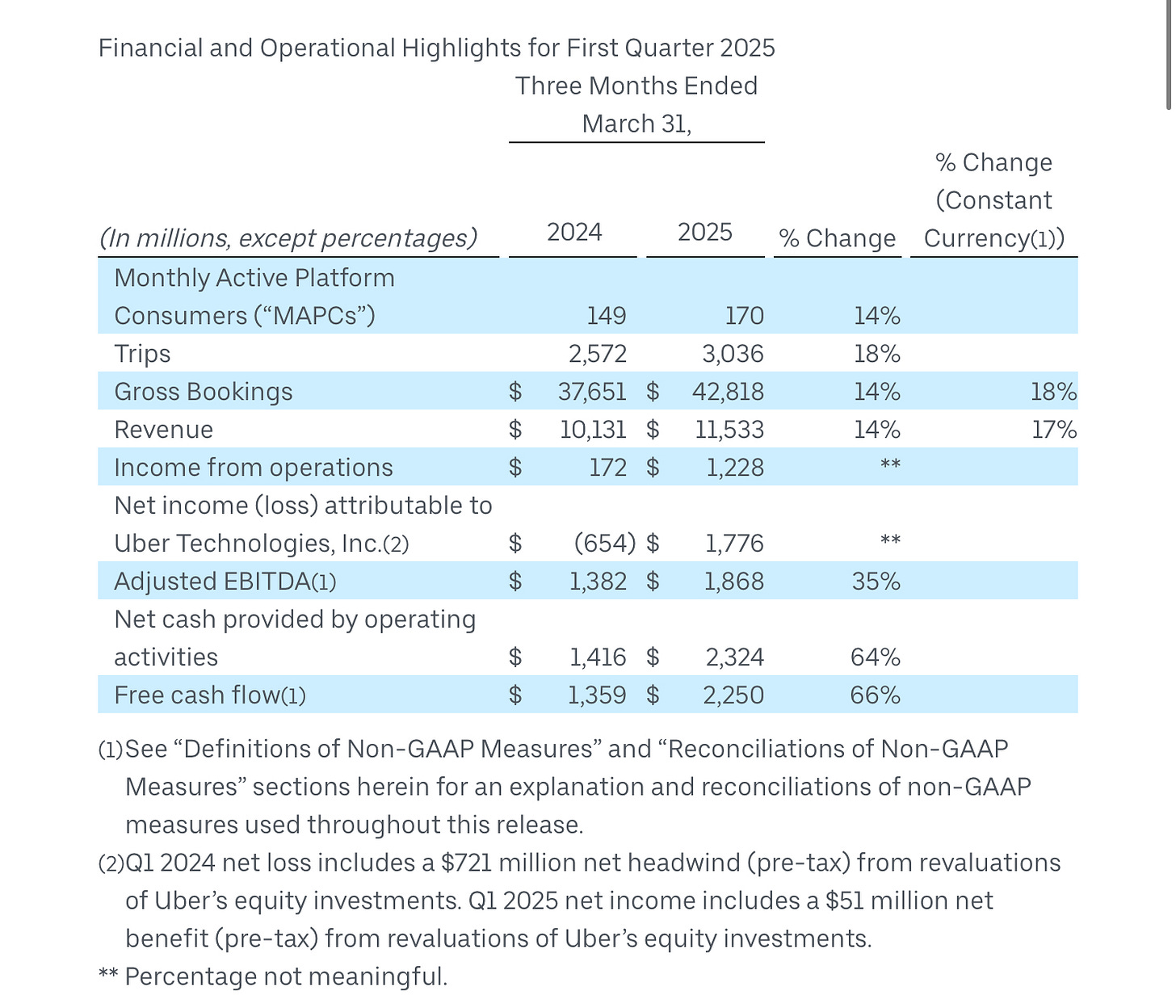

Q1 2025 Earning Summary

Highlights for 2024

In the fourth quarter of 2024, our MAPCs were 171 million, growing 14% compared to the same period in 2023. Overall Gross Bookings increased by $24.9 billion in 2024, up 18%, or 21% on a constant currency basis, compared to 2023. Mobility Gross Bookings grew 25% year-over-year, on a constant currency basis, primarily due to an increase in Mobility Trip volumes. Delivery Gross Bookings grew 17% year-over-year, on a constant currency basis, primarily driven by an increase in Delivery Trip volumes. Freight Gross Bookings declined 2% year-over-year, on a constant currency basis.

Revenue was $44.0 billion, up 18% year-over-year, primarily attributable to an increase in Gross Bookings of 18%. The increase in Gross Bookings was primarily driven by an increase in Mobility and Delivery Trip volumes. The increase in revenue was partially offset by business model changes in some countries that classified certain sales and marketing costs as contra revenue, which negatively impacted revenue by $863 million and $713 million across Mobility and Delivery, respectively.

Net income attributable to Uber Technologies, Inc. was $9.9 billion, which includes: (i) a $6.4 billion benefit from the release of our valuation allowance of certain U.S. federal and state deferred tax assets and (ii) the favorable impact of a pre-tax unrealized gain on debt and equity securities, net, of $1.8 billion primarily related to changes in the fair value of our equity securities, including: a $723 million net unrealized gain on our Grab investment, a $629 million net unrealized gain on our Aurora investment, and a $357 million net unrealized gain on our Didi investment.

Adjusted EBITDA was $6.5 billion, growing $2.4 billion year-over-year. Mobility Adjusted EBITDA was $6.5 billion, up $1.5 billion year-over-year. Delivery Adjusted EBITDA was $2.5 billion, up $965 million year-over-year. These increases were partially offset by a $57 million increase in Corporate G&A and Platform R&D costs, year-over-year We ended the year with $7.0 billion in unrestricted cash, cash equivalents and short-term investments. During the fourth quarter of 2024, we redeemed $2.0 billion of our outstanding debt.

In January 2025, we announced that we entered into an accelerated share repurchase (“ASR”) agreement with a large financial institution to repurchase $1.5 billion of our outstanding common stock as part of our previously announced Share Repurchase Program. The transactions under the ASR agreement were completed during the first quarter of 2025.

A Brief History of Uber

In Dec 2008, on a cold winter evening in Paris, Travis Kalanick and Garrett Camp couldn't get a ride. That's when the idea for Uber was born. They created Uber to make it easier and cheaper to procure direct transportation. In March 2009, the 2 entrepreneurs developed an app that let people tap a button and get a ride.The prototype of the mobile app was built by Camp and his friends, Oscar Salazar and Conrad Whelan, with Kalanick as the "mega advisor" to the company. On July 5, 2010, The first Uber rider requested a trip across San Francisco.

In February 2011, the company changed its name to Uber Technologies, Inc and its principal executive offices are located at 1725 3rd Street, San Francisco, California. The company began food delivery in August 2014 with the launch of the UberFRESH service in Santa Monica, California. In 2015, the platform was renamed UberEats and the ordering software was released as a standalone application initially launching in Toronto.

“Uber, which started with four people around a desk and two cars on the streets of San Francisco, is now a global success, serving 300 cities across six continents and recently reaching the one-millionth-driver mark. For starters, Uber’s vision is to set up shop in “thousands more cities,” add another million drivers this year, and grow the company’s carpooling service, CEO Travis Kalanick said in an anniversary speech to employees Wednesday. In his address, Kalanick talked about the state of the nation’s transportation system, and Uber’s role in filling the gaps left by public transit. He urged cities to adopt the innovative service.”

From the Washington post - Uber turns 5, reaches 1 million drivers and 300 cities worldwide. Now what?

In 2016, it commenced operations in both London and Paris. After launching the Delivery app, Uber Eats, the company believes their delivery offering increases consumer engagement with the Uber platform overall, which in turn results in broader reach for our Merchants who can attract Uber Eats consumers from Uber without increasing their own costs.

The New Uber

In August 2017, Dara Khosrowshahi, the former CEO of Expedia Group, replaced Kalanick as CEO. As Dara Khosrowshahi assumed the CEO role at Uber, he faced a broad set of challenges such as board alignment, reputation, image, brand, employee morale, driver sentiment, culture, and budget control. He reflected on some of the strategic actions he took in his early days as CEO:

There was a struggle within the board on who would control the company going forward. Control came first because the company doing well is a bit of a theoretical concept, but control is not. So, we had to reform the governance of the company. We got rid of the 10-vote shares, which were heavy control shares, and fully aligned the board on guiding the growth of the company versus controlling the company. This was an unusual circumstance, but it was very important to me as CEO to have a board that was aligned.

Reforming the culture of the company was another very strategic and important factor that had my attention. The company had grown to where it was, partially because of the aggressive culture prevalent in the organization. However, at some point, the revolutionaries become the incumbents and once you are the incumbent you cannot use revolutionary tactics. We had to reformulate the culture of the company to recognize that this was a company of great size and great power and with that comes great responsibility and we had to act accordingly.

Another strategic factor was how we aligned interests of the business with the various stakeholders of the company. Although we are a global technology company, we are highly unusual in how local we are with regards to local regulations, local city interests, and so on. So, we had to really focus on the interests of the stakeholders. How we treat drivers, how we think about safety, how we think about the environment, EVs, and regulations, etc. So that we actually became a growth vehicle that the mayors of the cities would celebrate versus the opposite. I made it clear to company leadership that we should be willing to sacrifice short-term business interests to align with long-term stakeholder management.

Vowing to do the right thing, Khosrowshahi had systematically set about transforming Uber after taking over as CEO. Under CEO Dara Khosrowshahi, Uber has shifted from a “move fast and break things” culture to “move fast and do the right thing,” prioritizing customers and employees alongside growth. Despite operating at a loss for nearly 14 years, Uber 2.0 overhauled its toxic culture and achieved its first operating profit, emphasizing ethical leadership, trust, and integrity.

He hired a new CFO in 2018 and worked towards an important milestone, the company’s initial public offering (IPO). In April 2019, Uber officially filed a prospectus for its IPO. Reported The New York Times, “The offering, which could value Uber at around $100 billion, is expected to reverberate through global financial markets and to solidify the company’s position as one of the most consequential technology firms of the past decade. Uber debuted on NYSE on May 19, 2019, and the stock sank on its first day of trading to $42 per share, giving the company a market cap of 69.7 billions.”

In 2024, Uber Technologies Inc. will buy back as much as $7 billion in shares to return capital to shareholders after reporting its first full year of operating profit and consistent positive free cash flow in 2023. The repurchase pl.an “is a vote of confidence in the company’s strong financial momentum,” Chief Financial Officer Prashanth Mahendra-Rajah said in a statement on Wednesday. “We will be thoughtful as it relates to the pace of our buyback, beginning with actions that partially offset stock-based compensation, and working toward a consistent reduction in share count.

Fast forward to 2025 - Uber has become a global company with a growing portfolio of products and services powered by one common technology platform.

Director and Senior management

Our Board of Directors has nominated the 11 director nominees listed below for election at the 2024 Annual Meeting. Each of the director nominees currently serves on the Board. The current term of all directors will expire at the 2024 Annual Meeting when their successors are elected, and the Board has nominated each of these individuals for a new one-year term that will expire at the 2025 Annual Meeting when their successors are elected. Each of the director nominees identified in this proxy statement has consented to being named as a nominee in our proxy materials and has accepted the nomination and agreed to serve as a director if elected by the Company’s stockholders.

Shareholder and Major Stock Ownership

As of Q1 2025, 0.61% of Uber's shares are held by insiders, indicating that company executives, board members, and other key stakeholders own a small portion of the company's total shares. Institutional investors hold 83.04% of Uber's shares, demonstrating strong interest and confidence from large financial entities such as mutual funds, pension funds, and hedge funds. Additionally, 83.55% of Uber's floating shares —which are available for public trading—are owned by institutions, further emphasizing their significant influence on Uber's stock. In total, 2,545 institutional investors hold shares in Uber, showcasing a broad base of institutional ownership.

Human Capital at Uber

Employees

We are a global company, and as of December 31, 2024, we and our subsidiaries had approximately 31,100 employees globally and operations in over 70 countries and more than 15,000 cities around the world. Our human capital strategies are developed and managed by our Chief People Officer, who reports to the CEO and is overseen by the Compensation Committee and the Board of Directors.

Our success depends in large part on our ability to attract and retain high-quality management, operations, engineering, and other personnel who are in high demand, are often subject to competing employment offers, and are attractive recruiting targets for our competitors.

Employee Engagement

To attract and retain the best talent, we strive to establish a culture where people are able to achieve their highest capability. We measure how successful we have been in establishing the culture we need through employee engagement surveys and related tools. We conduct continuous listening by collecting feedback from employees throughout the year and through various channels. We use the results of these regular checks to better understand employees’ needs and support their teams on topics such as well-being, rewards and recognition, and growth opportunities.

For example, our hybrid work approach was shaped based on employee feedback. In addition to the engagement survey results, we also monitor the health of our workforce and the success of our people operations through monitoring metrics such as attrition, retention, and offer acceptance rates.

Employee Development and Retention

We believe that employees who have opportunities for development are more engaged, satisfied, and productive. Employees are empowered to drive their own growth, whether by learning on the job, finding stretch assignments, participating in mentorship, or identifying their next opportunity within Uber through internal mobility programs. Employees have access to an internal jobs marketplace for full-time jobs as well as short-term stretch assignments that enable them to have an impact on other areas of the business.

Our goal is to help our employees be their best selves by providing programs and resources that promote wellness and productivity. Globally, Uber offers competitive benefits packages to our employees and their families.

Uber’s Operating Sectors

Mobility - Making every journey better

While most people associate Uber with ride-hailing, the Mobility unit has become much more than just hailing an Uber ride. Uber’s Mobility offering connects consumers with a wide range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and more—helping customers go almost anywhere they need. We believe our global leadership position—and the vast amount of marketplace data that comes along with it—means that we have the best technical and data platform to innovate faster than other companies with similar products. We believe our scale and global availability allows our Mobility segment to offer better consumer experiences to riders in a variety of vehicle types, providing consumers with higher reliability and Drivers with better earnings opportunities. Mobility also includes activity related to our financial partnerships, products and advertising.

Uber’s mobility business has a huge global footprint but at the same time it is very much a local business. Uber’s operations were regulated at a local level - whether it be safe, operational compliance, taxes, or pricing. Uber has taken what is at its core a local business and connected it to one global technology platform built for 72 countries. The tech team has built and deployed platform functionality at velocity and scale. Building and evolving a technology platform that enabled mobility operations in any given neighborhood, city, state, country, and global region. In Uber’s view, success in Mobility starts with drivers, the engine of growth.Local, on-the-ground operational execution has significantly increased our driver base with a 75% gain from Jan 22 to Dec 23. Driver growth will come from both traditional bases and new pools of supply.

Andrew Macdonald is the Senior Vice President of Mobility and Business Operations at Uber, he said

We are best in class at taking business insights, customer insights, driver insights and local insights and feeding them to our product and engineering team so that they could build a finely toned, world-class technology platform

Sundeep Jain, chief product officer and SVP of engineering, cited examples that highlighted the many ways the combination of Uber’s operations team and the technology team contributed to building a significant competitive advantage for the company:

Our local operations team figured out that in countries like Brazil and India, it was perfectly acceptable for a two-wheeler driver to put one single passenger on the back of their two-wheeler and provide a ride from point A to point B. While this is incomprehensible in the United States, it was quite commonplace and pervasive in those countries and became a high-growth business for us. The ops team established these types of use cases and the tech team built and evolved our tech to support the use cases.

Similarly, the tech team also comes up with insights that have had a big impact on operations. For example, the tech team developed insights based on pattern recognition of data using machine learning algorithms on where people were taking shared rides, identified hot routes, predicted routes that would have heavy traffic, and recommended routes for shared ride services. The ops team then implemented and supported shared rides for specific local areas.

It has become a two-way street between the two teams where there are types of products and services that naturally come out of tech and there are products and services that naturally come from ops. Both teams work hand in hand to drive growth for the company.

Uber derives Mobility revenue from service fees paid by Drivers for use of the platform and related service to connect with Riders and successfully complete a trip via the Platform, amounts charged to end-users for Mobility services, and fees charged to end-users for use of the platform in certain markets. We recognize revenue when a trip is complete.Depending on the market where the trip is completed, the service fee is either a fixed percentage of the end-user fare or the difference between the amount paid by an end-user and the amount earned by Drivers.

Delivery - Get anything

Our Delivery offering allows consumers to search for and discover the best of local commerce—from restaurants to grocery, alcohol, convenience and other retailers—order a meal or other items, and either pick-up at the restaurant or have it delivered. We refer to the grocery, alcohol, convenience, and retail categories collectively as Grocery & Retail.

Uber moved into food delivery by launching Uber east in Toronto and three US cities in 2015. Unlike ride-hailing, Uber faced several operational challenges in growing their share of the food delivery market. First, the food delivery industry was already well established and firms such as Seamless and Grubhub had dominant market share. This meant Uber was not first to market. Uber

After launching our Delivery app, Uber Eats, over eight years ago, we believe our Delivery offering increases consumer engagement with the Uber platform overall, which in turn results in broader reach for our Merchants who can attract Uber Eats consumers from Uber without increasing their own costs. For Drivers, we believe the Delivery offering leverages, and has expanded, our earner base by increasing utilization and earnings across the network. We also believe it also attracts new Drivers to the platform who do not have access to Mobility-qualified vehicles.

Over the last several years, our Delivery business has expanded to include Uber Direct, our white-label Delivery-as-a-Service offering to retailers and restaurants around the world, as well as advertising opportunities. We derive our Delivery revenue from service fees paid by Couriers and Merchants for use of the platform and related service to successfully complete meal preparation, grocery and other delivery service on the platform, amounts charged to end-users for Delivery services, and fees charged to end-users for use of the platform in certain markets.

We recognize revenue when a Delivery transaction is complete. In the majority of transactions, the service fee paid by Merchants is a fixed percentage of the meal price. The service fee paid by Couriers is the difference between the delivery fee amount paid by the end-user and the amount earned by the Couriers. End-users are quoted a fixed price for the meal delivery while we pay Couriers based on time and distance for the delivery. We typically receive the service fee within a short period of time following the completion of a delivery.

Freight

We believe that Freight is revolutionizing the logistics industry. Freight powers a managed transportation and logistics network and connects Shippers and Carriers in a digital marketplace to move shipments while leveraging our proprietary technology, brand awareness, and experience revolutionizing industries. Freight provides an on-demand platform to automate and accelerate logistics transactions end-to-end while providing visibility and control of logistics networks. Freight connects Carriers with Shippers’ shipments available on our platform, and gives Carriers upfront, transparent pricing and the ability to book a shipment with the touch of a button. Freight serves Shippers ranging from small- and medium-sized businesses to global enterprises. By leveraging logistics solutions expertise and value-add solutions, Freight enables Shippers to create and tender shipments, secure capacity on demand with real-time pricing, and track those shipments from pickup to delivery. Freight operations are principally based in North America and Europe. We believe that all of these factors represent significant efficiency improvements over traditional transportation management and freight brokerage providers.

Other businesses

Uber One Membership

With our platform, we are making it even easier for our consumers to unlock convenience—Uber One is our single cross-platform membership program that brings together the best of Uber. Uber One members have access to discounts, special pricing, priority service, and exclusive perks across our rides, delivery, and grocery and retail offerings. Uber One is available in over 30 countries. Our Eats Pass membership program continues to remain available in select cities as a subscription offering. Our membership programs are designed to make utilizing our suite of products a seamless and rewarding experience for our consumers. As of December 31, 2024, Uber One member base reached 30 million.

Advertising

Uber is also utilizing our data and scale to offer marketplace-centric advertising to connect merchants and brands with our platform network and unlocking cross-platform advertising formats. During October 2022, we officially launched Uber’s advertising division and introduced Uber Journey Ads, an engaging way for brands to connect with consumers throughout the entire ride process. We now offer a model that enables brands to partner with Uber on a variety of advertising options on the Uber and Uber Eats apps, and beyond, while connecting with consumers in brand-safe and captivating ways. We also provide comprehensive reporting and analysis, which helps brands fine-tune their understanding of consumers and create more impactful campaigns as they connect with consumers at relevant points throughout their journeys and transactions. We believe that our advertising further strengthens the power of our platform and will continue to do so as we onboard more advertisers.

Advertising isn’t a large part of Uber’s total revenue today, but the opportunity is huge. Ad revenue had an annualized run rate in the low-single-digit billions in the fourth quarter, but the digital market is hundreds of billions annually. Taking a little bit of market share would have a material impact on Uber’s revenue. When it comes to the conversation on Wall Street, nobody is talking about “their little gem of an advertising business and an audience waiting to be delivered ads,” says Jason Ware, chief investment officer at Albion Financial Group, which owns the stock. “The super app value is in advertising.”

Uber Will Get a Robo-Taxi Boost. Why It’s Time to Buy the Stock.Barron’s

The Tech Platform - Uber’s Secret Sauce

Uber is a technology platform that uses a massive network, leading technology, operational excellence, and product expertise to power movement from point A to point B. We develop and operate proprietary technology applications supporting a variety of offerings on our platform. We connect consumers with providers of ride services, merchants as well as delivery service providers for meal preparation, grocery and other delivery services. Uber also connects consumers with public transportation networks. We use this same network, technology, operational excellence, and product expertise to connect Shippers with Carriers in the freight industry by providing Carriers with the ability to book a shipment, transportation management and other logistics services. We are also developing technologies designed to provide new solutions to solve everyday problems.

"While it may not always be visible to the casual user or investor, this really is our secret sauce. Whether you're ordering a ride or delivering much of the underlying tech and tech enabled operations, identity maps payments, fraud detection, ordering, dispatching, pricing and more. They're all shared across Uber," he said. "In fact, around 75% of our engineering resources are focused on these shared elements. This advantage is also self-reinforcing as the lessons we learn in one business can be applied elsewhere and technical investments we make in one area accrue to the whole platform."

Khosrowshahi said the technology stack is the company's biggest advantage on Uber’s investor day 2024

Platform Synergies

Uber’s massive, efficient, and intelligent network consists of tens of millions of Drivers, Consumers, Merchants, Shippers, and Carriers, as well as underlying data, technology, and shared infrastructure. Our network becomes smarter with every trip. In more than 15,000 cities around the world (as of December 31, 2024), our network powers movement at the touch of a button for millions, and we hope eventually billions of people.We have built proprietary marketplace, routing, and payments technologies. Marketplace technologies are the core of our deep technology advantage and include demand prediction, matching and dispatching, and pricing technologies. Our technologies make it extremely efficient to launch new businesses and operationalize existing ones.

Our regional on-the-ground operations teams use their extensive market-specific knowledge to rapidly launch and scale products in cities, support Drivers, consumers, Merchants, Shippers, and Carriers, and build and enhance relationships with cities and regulators.

Our products are built with the expertise that allows us to set the standard for powering movement on demand, provide platform users with a contextual, intuitive interface, continually evolve features and functionality, and deliver safety and trust.

We intend to continue to invest in new platform offerings that we believe will further strengthen our platform and existing offerings. We believe that all of these synergies serve the customer experience, enabling us to attract new platform users and to deepen engagement with existing platform users. Both of these dynamics grow our network scale and liquidity, which further increases the value of our platform-to-platform users. For example, Delivery attracts new consumers to our network—for the three months ended December 31, 2024, approximately 61% of first-time Delivery consumers were new to our platform. Additionally, for the three months ended December 31, 2024, consumers who used both Mobility and Delivery generated 11.4 Trips per month on average, compared to 5.2 Trips per month on average for consumers who used a single offering in cities where both Mobility and Delivery were offered. We believe that these trends will improve as we further leverage the power of our platform.

As the SVP of engineering, Jain helped lead the 7000 person tech organization that was the brains behind the tech platform. He described the space at Uber as very unique and challenging:

At Uber, when we get a consumer requesting a ride to go from point A to point B at any time of the day, we have to move a two-ton car that’s driven to that user in five minutes. The big challenge is we don’t have inventory or the supply locked up like Amazon would have in its distribution center. Our drivers are independent contractors and they do what they want. We have a dynamic user request and dynamic supply. Our tech has to do an optimal match so that both the consumer and the driver achieve their objective. On the food delivery side, we have another player in the mix, which is the restaurant or merchant, and more variables at play such as preparation time, order volume, and delivery time. And when you add a very high scale on a global basis, the problem space becomes very complex and challenging.

Jain had structured the tech organization into four functions—engineering, data science, product management, and product design. While working on specific problems, project teams were organized within pods; each pod would have an engineering team, a product team, a design team, and a data science team. While Mobility and Delivery were different businesses, there were a fair number of underlying similarities between them for tasks such as matching, pricing, routing, integration APIs and design of the pixels on the smartphone app. As a result, many of the platform services including payments, identity, data, infrastructure were shared between the two businesses. In terms of the architecture, Jain highlighted the consumer-facing nature of the Uber app as an important factor, “We are building the architecture in a way that enables us to modify the app to optimize user experience. Very importantly, it is highly instrumented so that we can run experiments and measure the impact of different variables on outcomes. While the specific architecture depends on the end application, it is generally designed to be scalable on a global basis and support local nuances.

Many of the global operating metrics of Uber were very large—in millions and billions. For instance, there were 150 million active platform consumers in Q4-2024, 9.4 billion trips in 2023, and 10 million predictions per second. By any measure, these numbers reflected operations of immense magnitude. When you consider the fact that many transactions had significant unique local flavor, the true extent of the complexity and scale of Uber’s operations came to light. Jain offered the following insight on how his team handled scale through the use of AI technology:

“The advancements in AI technology in terms of machine learning and large-scale computing infrastructure have enabled us to do a better job of processing huge amounts of data and using it to make predictions and forecasts. No human can keep track of the operational parameters; those are being tracked, monitored, and learned upon by our machine learning models. Since we have been capturing data for many years now and given our scale, the data keeps compounding, which leads to our data advantage. As consumers use Uber, they generate data that improves our AI models, which in turn allows us to personalize, improve the workflow, and improve both consumer experience and driver/courier experience—and that leads to an increase in consumers, which is demand and drivers, which is supply.”

With regards to predictions generated by our algorithms, our number one goal is to predict consumer demand. And it’s not just how many orders we are going to get in a given day. We need to know how many orders we are going to get per 10-minute unit of time from what latitude/longitude. There’s a difference between getting a request from a rider at 9 a.m. versus 9:10 a.m. There’s a difference between getting a request from a street corner versus a kitty-corner across because that has an implication on how the Uber driver can get to the particular place. There’s an implication on how the driver is going to a residence in a cul-de-sac versus an apartment building.

We need predictions at a very granular level so we can position our drivers and couriers to be within a local area to fulfill predicted orders. Because we don’t tell the earners what to do, we have to use incentives, demand patterns, and heat-maps to help them maximize their earnings. And we have to make these demand predictions on a global level in real time, some of them a day in advance and some of them a week in advance. This is what drives up the number of predictions to 10 million per second.

The combination of vast amounts of transaction data and large-scale computing infrastructure provided the perfect foundation for conducting operational experiments. Technology companies in fields such as media, social, and search routinely used this capability to conduct operational experiments with new use cases. Introducing tested use cases helped improve customer retention. Jain characterized Uber’s experimentation infrastructure as being very expansive, effective, and unique:

“We run everything through experiments before introducing anything into the field. We don’t use intuition but we do use experiments to drive our decisions. Like everyone else, we use AB testing. But in our case, any type of experiment we do changes both sides of the marketplace. If we offer a consumer a different price, it means we have to offer drivers a different incentive so that changes the dynamics. Our experiment infrastructure enables us to monitor the multi-side or second-order effects of changes in the marketplace. We can also conduct experiments in one geographic region and port the results into another geographic region. For instance, we can run an experiment in Brazil and know which qualities of that experiment can be ported over to the U.S. We can parse geographies, users, and other variables to give us higher velocity and reach of experiments.”

The Implications of AVs for Uber

2024 was a turning point for the industry, as AV technology began to mature and more people experienced the magic of their first autonomous ride. Multiple AV developers, including Waymo, WeRide, Pony, and Baidu, are now offering fully self-driving rides to the public in geofenced areas. Many others, including Avride, Mobileye, Nuro, Tesla, and Zoox could reach that milestone in the coming quarters or years. Naturally, investors are debating whether AVs pose a risk or present a massive opportunity for Uber. Based on our deep engagement with AV technology developers, auto OEMs and other experts and technologists in the ecosystem, I am more confident than ever that Uber is uniquely positioned to capture the $1 trillion opportunity that autonomy will unlock in the US alone.

Even as we see AV technology advancing, we expect AV commercialization will take significantly longer. Several pieces of the go-to-market puzzle still need to come together, including: a consistently super-human safety record; enabling regulations; a cost-effective, scaled hardware platform; excellent on-the-ground operations; and a high-utilization network that can manage variable demand with flexible supply.

Every one of these five pieces must work in concert, or the puzzle falls apart. For example, even the lowest-cost AV fleet will struggle to generate revenue if its vehicles are not highly utilized. And even a well-utilized but fixed fleet will struggle to meet consumer demand at peak times.

Excerpt from Q4 2024 Prepared Remarks

Autonomous is the future of ride sharing. The global self-driving taxi market, which is around $1 billion now, could grow to more than $2 trillion over the next decade, according to Evercore. The big risk to Uber is that companies like Tesla and Waymo go it alone, dramatically reducing Uber’s ride-hailing market share. Even if Waymo decides to partner up on ride sharing, Uber has to share a cut with Waymo, so the profit margins on these trips would be lower. There’s a real possibility, though, that Waymo and others will put more cars on the road, making ride sharing more accessible and widespread, even if they don’t all use Uber. But if Uber were able to increase the number of total rides, its earnings would still get a boost, even if the driverless business is less profitable. And ultimately, it should be seen as a tailwind, not a headwind, Devitt says.

“The [ride-share] market expands because there’s more and more use cases,” he explains. “That leads to more density of vehicles. That is super-bullish for Uber long-term.”

Under this scenario, Uber’s growth rate would go from fast to faster. The company, which saw over half of its total $44 billion in 2024 revenue from rides and about a third from UberEats food delivery, grew the top line 20% during the fourth quarter of 2024. Management’s first-quarter guidance called for 19% first-quarter gross bookings growth at the midpoint of the range, with the slight decrease driven entirely by a stronger U.S. dollar. Uber has the potential to grow sales well above 20% in the years ahead.

Uber Will Get a Robo-Taxi Boost. Why It’s Time to Buy the Stock - Barron’s

Is Uber a Franchise Business?

Uber operates as a dynamic marketplace that we believe warrants a narrow moat rating based primarily on network effects. While other rivals also enjoy network effects, none have Uber’s scale, which provides Uber with a cost advantage in which fixed costs are spread across more trips. The firm also fosters unmatched engagement, which provides an intangible asset in the form of user data. This user data contributes to virtuous cycles where increased trips leads to more data and more data leads to improved application performance and improved application performance leads to more trips. The strength of Uber’s network effect is the critical determinant of its ability to maintain returns above its cost of capital over time.

Morningstar research report

1. Cost and Revenue Advantages

Uber benefits from an asset-light model, meaning it does not own vehicles or employ drivers, keeping fixed costs low. It also leverages algorithmic pricing and operational efficiencies to reduce costs over time.

Revenue Advantages – Uber has dynamic pricing (surge pricing), which helps maximize revenue based on real-time demand. It also cross-sells services like Uber Eats and Uber Freight, increasing revenue streams.Uber’s business model has strong network effects that reinforce supply and demand growth 170mm monthly customers and 8mm drivers across 70 countries Large demand increases driver utilization; Large driver supply decreases wait times and user prices

2. Customer Demand Advantages

Uber benefits from strong network effects: more drivers lead to shorter wait times, which attract more riders, increasing demand and, in turn, drawing in more drivers. This cycle reinforces customer loyalty, as many users are accustomed to Uber and less inclined to switch. Leading global two-sided marketplace with strong and growing network effects and ingrained consumer behaviors driving expanding user frequency. Strong consumer and driver synergies from integrated and scaled mobility and delivery platform

Beyond ride-sharing and food delivery, Uber aims to evolve into a “super app,” offering a seamless platform for rides, food, and travel bookings. While this vision is not a current market focus, it remains a long-term goal. Uber doesn’t necessarily need to acquire Expedia Group—an option it reportedly considered in October, according to the Financial Times—to enter the travel space. Even a small foothold in the market could enhance Uber’s ecosystem and bolster its advertising business by increasing user engagement.

3. Economies of Scale and Sustainable Competitive Advantages

Uber also has economies of scale in technology and data: The more trips it facilitates, the better its algorithms and demand prediction become. Centralized tech infrastructure means each new ride costs less to operate at scale.Regulatory and driver acquisition costs remain high, limiting profitability and eroding some scale advantages.Large degree of fixed-costs allow for significant operating leverage (e.g. 3% annual headcount growth vs. 20% annual bookings CAGR since 2019). Continued focus on operational efficiencies will limit future expense growth.

Regulatory Moats – In some cities (e.g., California, New York), Uber has lobbied for rules that favor its business model, making it harder for new entrants. Data and AI-driven operational efficiency – Uber’s vast ride data improves matching, pricing, and logistics, which new competitors struggle to replicate. Competitive Threats – Uber constantly faces competition from other ride-hailing companies and even emerging autonomous vehicle platforms, which could erode its long-term edge.

With steady user growth and increasing engagement, Uber has cemented its place as a vital service for millions globally. As a dominant force in ride-hailing and delivery, the company has demonstrated resilience and agility in ever-changing markets. By prioritizing user expansion and deeper engagement, Uber is well-positioned for continued growth. With a strong presence in two thriving sectors, it remains committed to creating lasting value.

(I’ll do a seprate post on Uber’s valuation, thanks a lot for reading!)